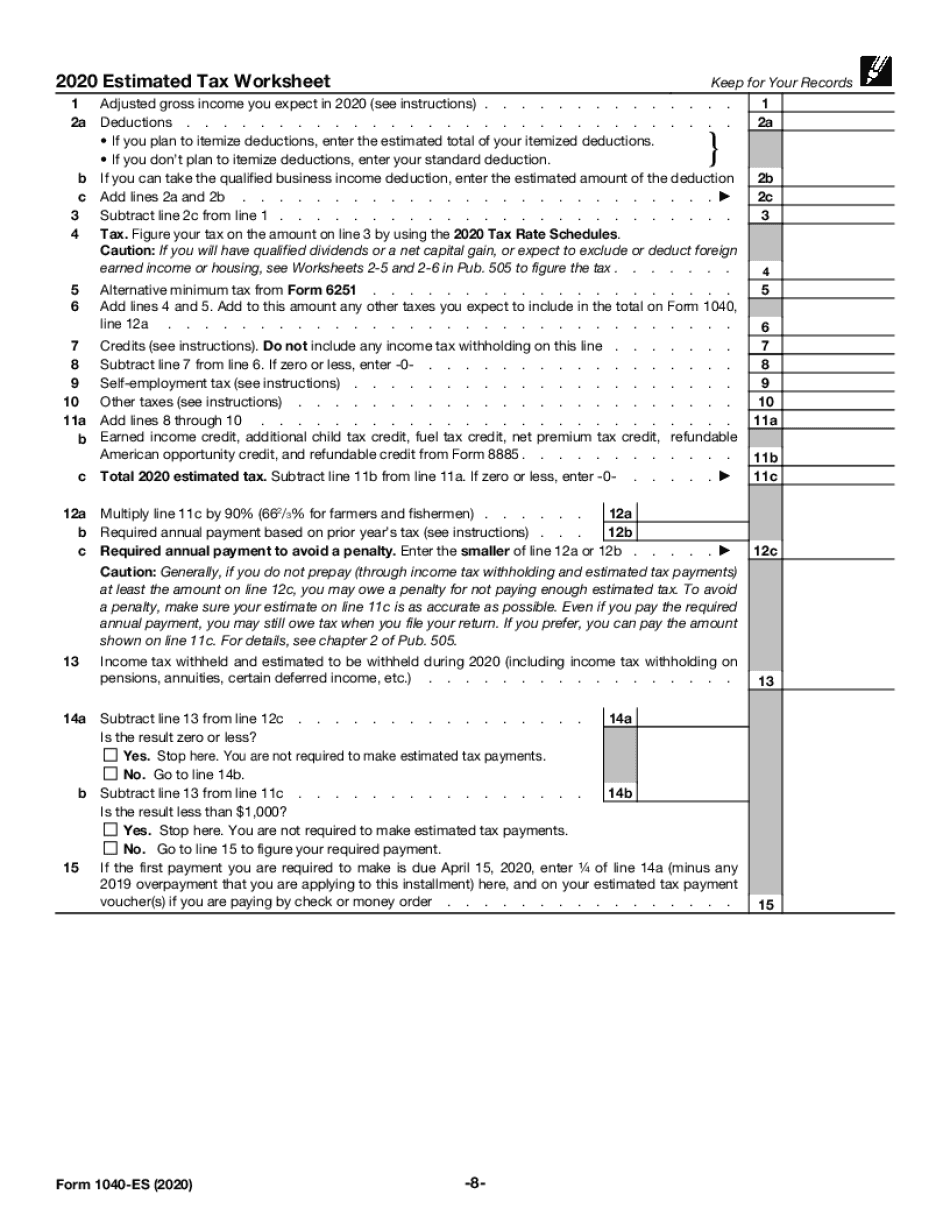

When completing a form electronically, please download the form prior to completing it to obtain the. From here, you should see Form 1040-ES in the list of forms included with your return. Electronic filing is fast, convenient, accurate and easy. To check that the forms were added to your return, you can go to Tax Tools in the left menu, then Tools.

Answer the questions about things like your 2023 filing status, income, and deductions.Answer No to the question Do you want to change your W-4 withholdings for 2023?.When your return is open, search for 1040-es (be sure to include the hyphen) and select the Jump to link in the search results.Sign in to your TurboTax account, then open your return by selecting Continue or Pick up where you left off in the progress tracker.Report of Estimated Tax for Nonresident Individual Partners and Shareholders Description of Form IT-2658 Payments due April 18, June 15, September 15, 2023, and January 16, 2024įorm IT-2658 is used by partnerships and S corporations to report and pay estimated tax on behalf of partners or shareholders who are nonresident individuals.You can print next year's estimated tax vouchers (Form 1040-ES) in your 2022 program: Reconciliation of Estimated Income Tax Account for Fiduciaries These free PDF files are unaltered and are sourced directly from the publisher. Underpayment of Estimated Tax By Individuals and Fiduciaries (for tax year 2022)Įstimated Income Tax Payment Voucher for Fiduciaries Payments due April 18, June 15, September 15, 2023, and January 16, 2024 IRS Form 1040-ES is the Estimated Tax for Individuals form obtained from the Internal Revenue Service which is used to figure and pay your estimated tax to the. Click any of the IRS 1040-ES form links below to download, save, view, and print the file for the corresponding year. Reconciliation of Estimated Tax Account for Individuals Income tax estimated forms (current year) Form numberĮstimated Tax Payment Voucher for Individuals Payments due April 18, June 15, September 15, 2023, and January 16, 2024 To check that the forms were added to your return, you can go to Tax Tools in the left menu, then Tools. Fill out the form in our online filing application. If you get the No Payments screen instead, you don't need to make 2023 estimated payments based on what you entered. Using an incorrect mailing address could delay the processing of your tax forms. Answer Yes and we'll include your 2023 1040-ES payment vouchers when you print a copy of your return later. See the instructions for the form you are filing to verify the correct address to mail your form and payment.

0 kommentar(er)

0 kommentar(er)